Table of Content

Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters. Every day, about 10,000 baby boomers turn 65, the “traditional” age for retirement – or at least, the age when many people decide to call it quits and leave their jobs. In years past, many retirees could count on a workplace pension combined with Social Security benefits and personal savings to help them afford their retirement as long as they had modest financial needs. The new mortgagor will base their calculations for qualifying based on the assumption that your line of credit is fully drawn. I have plenty of friends who have paid off their mortgages and loans as soon as they came into money, and vowed, ever since, never to take out another loan in their lives. Home Equity Credit Line "Because your home equity line of credit is secured by your home, the interest rate is usually lower than with other types of loans."

Home equity loan amounts range from $5,000 to $500,000, while HELOC line amounts range from $50,000 to $500,000. It offers both home equity loans and HELOCs in 47 states, with the option of interest-only HELOCs available to qualified borrowers. You also have the option to lock all or part of your outstanding HELOC balance into a fix-rate option during your draw period. Available loan amounts for HELOCs and home equity loans range from $15,000 to $750,000, and up to $1 million for properties in California. Average home equity loan rates are currently 7.8%, which is higher than the average rate for a 30-year fixed mortgage at 6.78%. You'll want to consider what type of financial institution best suits your needs.

Home Equity Line of Credit (HELOC) Rates

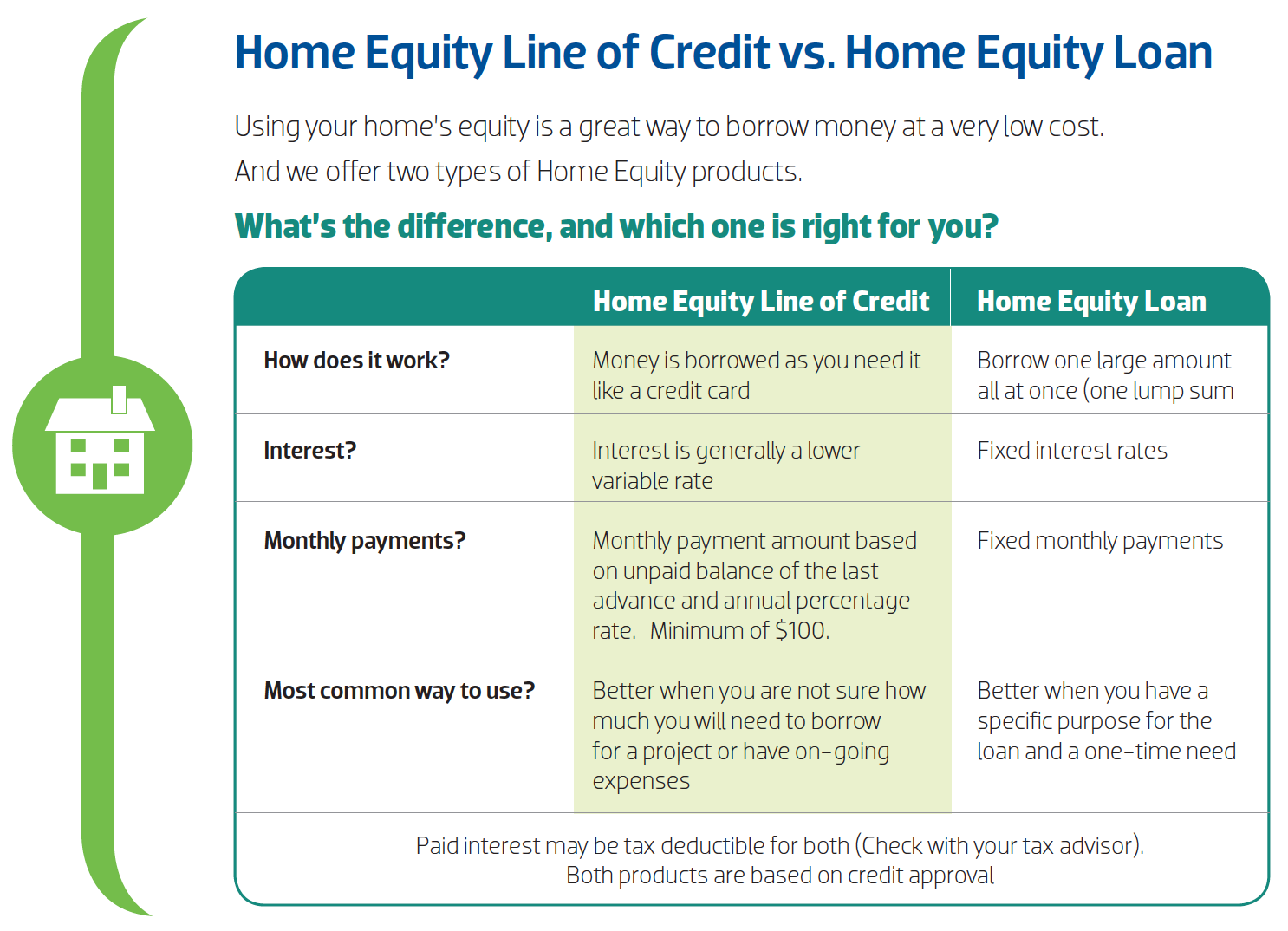

If you need funds to cover unexpected expenses or to consolidate personal obligations, our equity financing will make your borrowing fast and easy. "You're able to borrow from your home as a line of credit, similar to borrowing with a credit card. You can borrow what you need, as you need it, up until you reach your credit limit." In order to compare mortgage products, you must "Add Compare" at least one more product from this table or any other Mortgage table.

Second mortgages, like home equity loans and lines of credit , don’t alter a homeowner’s primary mortgage. This lets them borrow against the value of their home without needing to exchange their primary mortgage’s current rate for a new, higher one. We like that BMO Harris offers both home equity loans and three types of HELOCs almost nationwide, but the lender fell short because of its low price transparency.

Prosperity Bank

In addition to mortgage lenders, financial institutions that offer home equity loans include banks, credit unions and online-only lenders. Fifth Third Bank offers among the most customer-friendly home equity loans with the ability to tap more of your home’s equity and a lower credit score requirement than most competitors. As of September 27, the lender had a starting rate of 6.74% for a good-quality borrower, according to a bank representative. BMO offers home equity loans from five to 20 years, with loan amounts starting at $5,000.

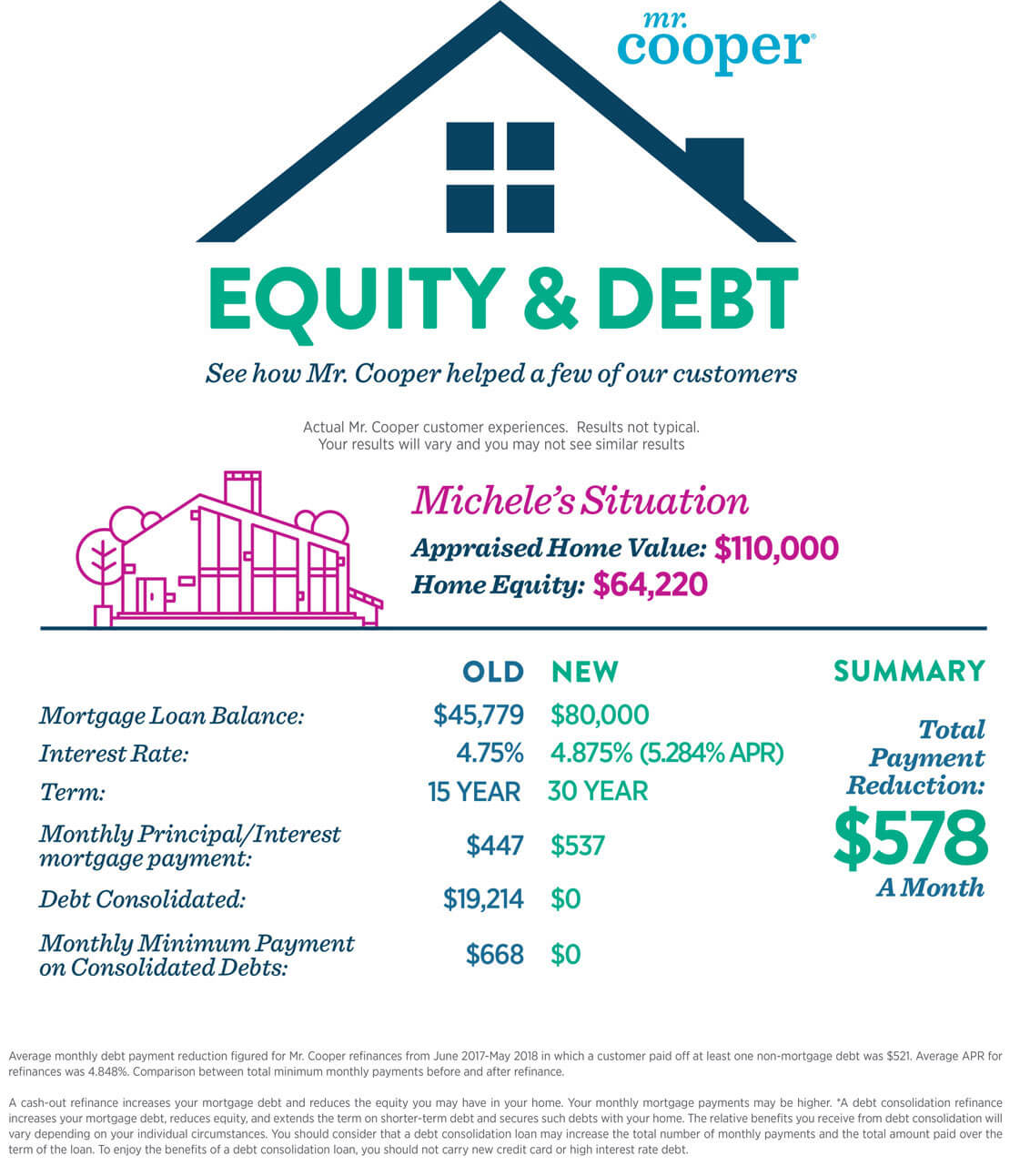

(approximately 10%) Opening several credit accounts in a short period of time can represent greater risk; especially for people with short credit histories. Eliminate high-interest rate debt and consolidate your payments into one low monthly cost. If you plan to use the money from your Home Equity Loan to make home improvements, you may be able to deduct some or all of your payments on your federal tax return. Whether you need to pay down credit card debt, make home improvements, or care for an elderly parent, the equity you’ve built in your home can serve as collateral for your loan.

Best Home Equity Loan Rates for December 2022

All memberships and lending products are subject to approval including credit approval. Home Equity loans can be in either 1st or 2nd lien position, so homeowners are able to access equity without refinancing their primary mortgage loan. A Home Equity loan has limits that are set forth by the Texas Constitution, which only allows for 80% of the value of a home to be accessed.

However, HELOCs are secured loans that are backed by your property, so they tend to affect your credit score less because they're treated more like a car loan or mortgage by credit-scoring algorithms. A home equity loan, which lets you borrow money against the equity you've built in your home, provides you with a lump sum of cash at a fixed interest rate. Home equity loans and HELOCs are both technically second mortgages on your home.

Home equity lines of credit, better known as HELOCs, work a bit like a credit card where your home acts as collateral and your home equity determines the credit limit. During the draw period, you can keep borrowing money up to your HELOC’s credit limit. Then, when the draw period ends and the repayment period begins, you’ll pay back what you borrowed. Cash-out refinancing makes sense when you can get a lower refinance rate than your existing mortgage rate. However, that may be difficult for many homeowners in this current rate environment. When mortgage rates are high, home equity loans — which don’t alter the rate on your primary mortgage — tend to be a cheaper option than cash-out refinancing.

After reviewing your application and checking your credit, the lender will tell you how much you can borrow, your interest rate, your monthly payment, your loan term and anyfeesinvolved. Once you agree to the loan terms, the financial institution will disburse funds as one lump sum. Established in 1935, Connexus offers auto loans, personal loans, student loans, credit cards, banking products and more.

"Cadence offers competitive rates, reasonable closing costs and the convenience of easy 24/7 access to your money." You can apply for pre-approval at any time, regardless of whether you've completed the prequalification process. You'll complete a full mortgage loan application, which will include the following information. Whether you're looking to compare mortgage types, calculate a new auto loan payment or get your savings plan in order, we have the calculator for you. Investors, house-hunters and homeowners may wonder if a housing market crash is on the horizon in Houston.

Experts don’t recommend using a home equity loan for discretionary expenses like a vacation or wedding. Instead, try saving up money in advance for these expenses so you can pay for them in cash without taking on unnecessary debt. HELOCs often have variable interest rates that are directly tied to an index – the prime rate – that moves in lockstep with the federal funds rate. When the Fed hikes rates, it becomes more expensive to borrow with a HELOC. Low mortgage rates, rising demand, and low supply drove up home prices in 2020 and 2021, leaving many homeowners with increased home equity. You can apply for a home equity loan from Discover online or over the phone.

No comments:

Post a Comment